|

Opalesque Industry Update - UMass Amherst's Isenberg School of Management's Center for International Securities and Derivatives Markets (CISDM) has released its September Equally Weighted Hedge Fund Index. The CISDM Equal Weighted Hedge Fund Index was up 1.09% for the month of September. These are the final figures.

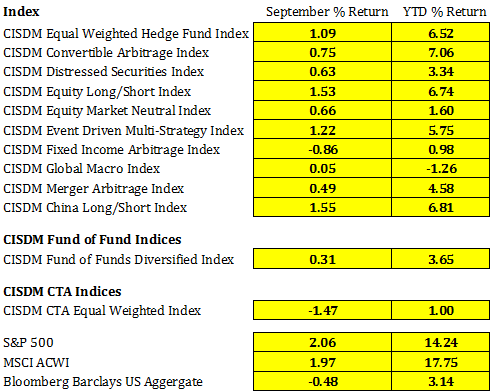

The CISDM Equal Weighted Index gained 1.09% in September and is up 6.52% for the year 2017. This was the eleventh monthly gain for the CISDM Equal Weighted index in the last twelve months. With an annualized volatility of 3.2% for the last twelve months, the Equal Weighted Index produced a very attractive Sharpe Ratio of above 2 over the last twelve months. Equities around the world rallied once again in September. The S&P 500 Index gained 2.06% in September to increase its year-to-date return to 14.24%. The MSCI ACWI gained 1.97% in September and is up 17.75% for the year. Most of the individual hedge fund strategies produced positive returns in September with the Equity Long/Short strategies gaining the most. The CISDM Equity Long/Short Index was up 1.53% for the month and 6.74% for the year. Muted volatility and continued upsurge in the broader equity market likely resulted in such good performance for the Equity Long/Short strategies. Energy, Financials and Industrials sectors made robust gains in September, helping sector-focused Equity Long/Short strategies. China Long/Short Index gained as well in September and is up 6.81% for the year. Hedge Funds focused on fixed-income securities had mixed performance in September. Convertible arbitrage and distressed securities strategies gained for the month, while fixed-income arbitrage lost money. As convertible arbitrage and distressed securities have positive exposure to improving credit conditions, a surging equity market helped alleviate fears of credit crisis and helped both strategies. Fixed-income arbitrage, on the other hand, lost 0.86% for the month, but is still up 0.98% for the year. Event driven hedge fund strategies, such as the CISDM Event Driven Multi-Strategy Index and the CISDM Merger Arbitrage Index, gained in September. Large number of mergers and acquisitions were announced in September, including United Technologies' $30.2 billion offer for Rockwell Collins and Northrop Grumman's $9.2 billion offer for Orbital ATK. The CISDM Fund of Funds Index had a modest 31 basis points gain for September as most of the hedge fund strategies produced positive return. This index gained for the tenth time in the last eleven months. |

Industry Updates

CISDM Equal Weighted Hedge Fund Index up 1.09% for September

Tuesday, October 31, 2017

|

|

RSS

RSS